proposed federal estate tax changes

Proposed Federal Estate Planning Changes. With indexation the value was 549 million in 2017 and with the temporary doubling of the exemption and inflation adjustments is 117 million in 2021.

Inheritance Tax What Is An Inheritance Tax Taxedu

Decrease of Estate and Gift Tax Exemption The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for.

. Next Steps in Estate Planning. With inflation this may land somewhere around 6 million. The exemption was indexed for inflation and as of 2021 currently stands at 117 million per person.

Reduction of the estate and gift tax exclusion currently at 117 million to 35 million Imposition of capital gains tax on appreciated assets transferred during life or at death. The House Ways and Means Committee proposal accelerates this reduction lowering the exemption amount to 6020000 after the. The taxable estate is taxed at 40.

The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018. The current estate tax exclusion for an individual is 117 million effectively 234 million for married couples. This was anticipated to drop to 5 million adjusted for inflation as of January 1 2022.

Here are some of the possible changes that could take place if Sanders proposed tax changes become law. The following summarizes some of the proposed estate and gift tax changes. The maximum estate tax rate would increase from 39 to 65.

Under the SandersWhitehouse proposal the estate tax rate would be increase to 45 for taxable estates valued between 35 million and 10 million 50 for estates over 10 million but less than 50 million 55 for estates between 50 million and 1 billion and 65 for estates over 1 billion. Grantor Trusts Grantor trusts trusts whose taxable activity and income are reported on the income tax returns of the persons who created the trusts have been a target of proposed legislation this year. Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion.

In addition the proposed rule would make death a transaction. One other concern of this tax is that it is based on deferred gain and not net worth. The Biden administration proposals must first be approved by Congress.

After 2025 with the reduction in the estate tax exclusion this owners estate would owe 1715334 in estate taxes. Many tax experts agree that changes to the tax code are likelier to happen now that the executive and legislative branches of the US. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation.

Current law provides that the individual estate and gift tax exemption will be reduced to 5000000 adjusted upwards each year for inflation in 2026. Government are aligned politically. Impose a minimum 15 corporate income tax on the book earnings of large corporations.

The federal gift estate and generation-skipping transfer GST tax exemptions that is the amount an individual can transfer free of any of these taxes are 117. Here is a summary of the current laws and the proposed changes. If an estate contains assets in excess of the exemption amounts those.

The proposed rule would mandate that the heirs would take on or carry-over the basis of the decedent. Lowering the estate tax exemption The Biden campaign proposed reducing the estate tax exemption to 35 million per person 7 million for a married couple which is. However under the legislative proposals.

Two of the most significant proposed changes include. One of the proposals would reduce the estate tax exemption to anywhere between 35 and 5 million with an effective date of January 1 2022. In addition the proposed bill provides that estates or trusts with income over 100000 would be subject to an additional 3 tax on their modified adjusted gross income.

The exemption applies to total bequests and gifts separate from the annual inter- vivos gift exemption of 15000 per donee for 2021. Effective January 1 2022 the federal estate and gift tax exclusion will be cut in half to about 60 million after. The 2017 Tax Cuts and Jobs Act TCJA overhauled federal taxation in many ways.

Thus in the example above. A person can currently transfer up to 117 million of assets at death without incurring any Federal Estate Tax. Trusts Taxation and Planning for Your Future Proposed Estate Planning.

Together with the transfer tax the net worth of this estate would be reduced by almost 40 by the two taxes. An estate tax would never make a farm insolvent owe more in. The estate tax lifetime exemption is 117 million per taxpayer.

2026 Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act It includes federal estate tax rate increases to. Estate and Gift Tax Exclusion Amount.

Estate gift and GST tax exemptions will remain at 117 million with increases allowed for inflation in 2022-2025. A reduction in the federal estate tax exemption amount which is currently 11700000. The estate tax rate is a flat 40.

As Congress is now considering these tax law change proposals the following is a summary of some of the most important. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. Another proposal would bring new rules to grantor trusts including a change to how life insurance held in a trust would be taxed12 At this point many ideas are being evaluated but nothing is final.

While the Committees plan may seem burdensome clients still. Current Transfer Tax Laws. Increase the corporate income tax rate from 21 to 28.

For the 995 Act Lifetime estate and gift tax exemptions reduced and decoupled The bill would reduce the current federal estate and gift tax exemptions of 117 million per person to 35 million for transfers at death and 1 million for lifetime gifts. Federal estate and gift tax are assessed at a flat rate of 40. The law would exempt the first 35 million dollars of an individuals gross taxable estate or 7 million for a married.

Decreased Estate Tax Exclusion.

New Estate And Gift Tax Laws For 2022 Youtube

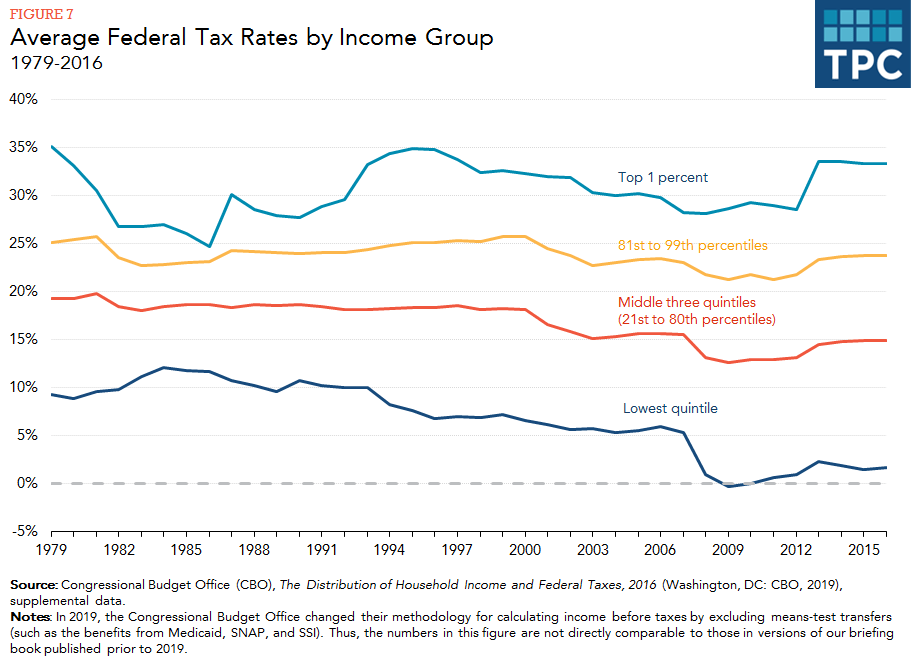

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

It May Be Time To Start Worrying About The Estate Tax The New York Times

Restricting The Step Up In Basis Tax Loophole Would Hit Heirs To Houses And Retirement Portfolios Whose Val Retirement Portfolio Family Finance Wealth Transfer

Estate Tax Definition Federal Estate Tax Taxedu

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Could We Reform The Estate Tax Tax Policy Center

The Generation Skipping Transfer Tax A Quick Guide

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

How Could We Reform The Estate Tax Tax Policy Center

The Generation Skipping Transfer Tax A Quick Guide

How The Tcja Tax Law Affects Your Personal Finances

What Are The Consequences Of The New Us International Tax System Tax Policy Center

2018 Real Estate Tax Reform Guide The Bateman Group Estate Tax Online Real Estate Getting Into Real Estate